Washington state solar incentives 2020 when installing solar panels in washington homeowners are eligible to get 26 the cost of installing solar back in taxes using a federal solar tax credit while paying no local or state sales tax effective july 1st 2019.

Solar panel subsidy washington.

D c s stand out solar program low income residential solar.

The solar investment tax credit itc is a federal tax credit for solar systems placed on residential under section 25d and commercial under section 48 properties.

Eligible district residents can participate in solar for all single family solar or community solar options if the household income is below 80 of the area median income ami threshold.

A unit that cost 60 000 in 2008 might cost just 20 000 today before the incentives according to clippard.

This first come first served rebate program provides qualified applications with up to 10 000 to cover the full cost of a 3kw to 4kw solar system.

Other offers subsidy of the government for installing a rooftop pv panels solar system except subsidy people can avail various other benefits by installing a rooftop solar system.

Here s an example of how the numbers work for a purchase of a 5 kw rooftop solar system in washington.

To 26 in 2020 to 22 in 2021 and thereafter it is 0 zero for homeowners and 10 for businesses.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing.

Installing a typical 5 kw solar system should start at about 18 750.

Qualified solar energy equipment is eligible for a cost recovery period of five years.

Those planning to install rooftop pv systems can avail priority sector loans of up to 10 lakhs from nationalized banks.

An average sized residential solar.

In december 2015 congress acted to extend the 30 tax credit through 2019 with a step down in subsequent years.

I a solar energy panel frame a support bracket or any visible piping or wiring to be painted to coordinate with the roofing material.

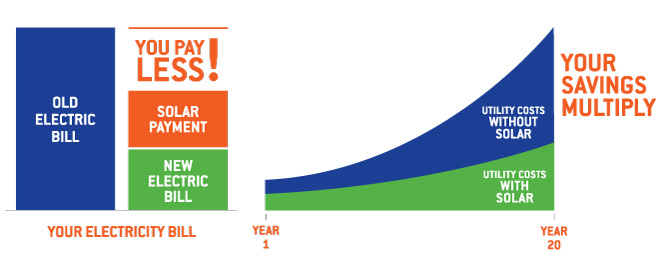

You may be eligible to finance your solar panel system purchase using a subsidized solar loan with a reduced interest rate.

The feds offer a tax credit of 30 of out of pocket costs so you ll get 5 625 back next april.

Accelerated depreciation can reduce net system cost by an additional 30 percent.

Solar for all s specific targets are to provide the benefits of solar electricity to 100 000 low income households and to reduce their energy bills by 50 by 2032.

The solar advantage plus program is a truly incredible and unique incentive for eligible low income d c.

These loans may be offered by your state a non government organization or your utility company but are usually only available for a limited time.