With the itc you can deduct 26 percent of the cost of your solar equipment from your taxes that means major savings on your solar installation.

Solar panel subsidy virginia.

Solar has taken off in virginia over the past five years the total solar output in the state has increased from just 17 megawatts in 2014 to more than 320 megawatts as of august 2018.

Solar power performance payments provide small cash payments based on the number of kilowatt hours kwh or btus generated by a renewable energy system.

Dominion energy has announced plans to develop multiple utility scale solar projects in virginia through 2020.

The federal government provides a solar tax credit known as the investment tax credit itc that allow homeowners and businesses to deduct a portion of their solar costs from their taxes.

In 2011 the wv legislature passed sb 465 to support the alternative fuel vehicle and infrastructure tax credit including solar.

Dominion energy virginia s most recent long term plan forecasts the potential for at least 15 900 megawatts of solar in the state over the next 15 years to meet customers energy needs.

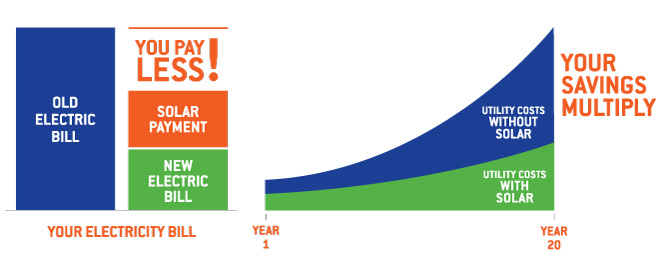

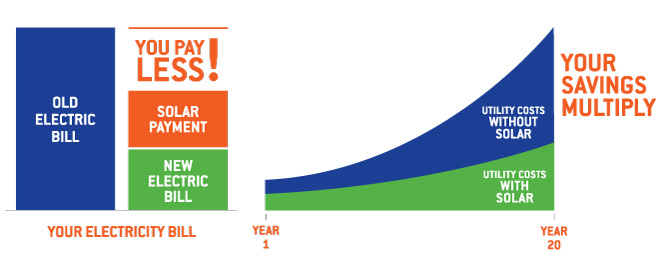

Yes the whole range of zero down payment options are available in virginia from loans to leases to power purchase agreements ppas.

In virginia i have read like wa state if solar panels are manufactured in virginia there are special tax credits however that does nothing to help people who are retired and building a new small home to retire into.

The benefits of going solar in virginia federal solar energy tax credit itc without a doubt the federal solar tax credit also referred to as the investment tax credit is one of the best incentives available for property owners in virginia.

Both homeowners and businesses qualify for a federal tax credit equal to 26 percent of the cost of their solar panel system minus any cash rebates.

These are increasingly popular and offer a great way to leverage your solar investment or simply to power your home with green energy without spending big wedges of greenback.

The bill s main purpose was to support the downstream gas industry to build the infrastructure to power natural gas powered vehicles but also included other forms including solar.

Solar energy equipment tax exemption code of va 58 1 3661 potential applicants.

Business industry and residents this statute allows any county city or town to exempt or partially exempt solar energy equipment from local property taxes.