This includes safety inspections at the time of installation post installation audits and a multi agency enforcement group which includes the cec where issues are discussed and action.

Solar panel rebates victoria 2015.

The victorian government offers rebates for solar.

Small scale technology certificates stcs.

The maximum value of the rebate is 1 850.

For more information and to check your eligibility visit solar victoria.

State government solar rebates are back but this time they re a bit like tickets to a hit concert that is there s a strictly limited number available each month and they will be snapped up quickly.

There are three incentives available to victorians replacing an existing hot water system with either a solar hot water system or a heat pump water heater.

Up to 50 off up to a maximum of 1 850 off the purchase of a new solar system.

Solar panel pv rebate eligible households can claim a discount on the cost of a solar panel pv system up to a maximum rebate of 1 850.

Solar homes package rebates.

Information in community languages.

Safety audit for your solar system.

Battery rebates up to a maximum of 4 174.

Solar for community housing.

Solar for rental properties.

Victorians the wait is over.

We are providing a rebate of up to 1 850 for solar panel pv system installation for homeowners and rental properties.

What else is solar victoria doing to protect consumers.

Solar panel pv rebate.

Interest free loans on solar purchases to be paid off over four years.

The solar homes package includes a 1 000 rebate for the installation of solar hot water.

Panels for rental properties.

There is no maximum minimum size for solar pv systems eligible for the rebate.

Everything you need to know about the new solar and battery rebates in victoria as of july 1 2019.

To further reduce installation costs householders can apply for an interest free loan for an amount equivalent to their rebate amount.

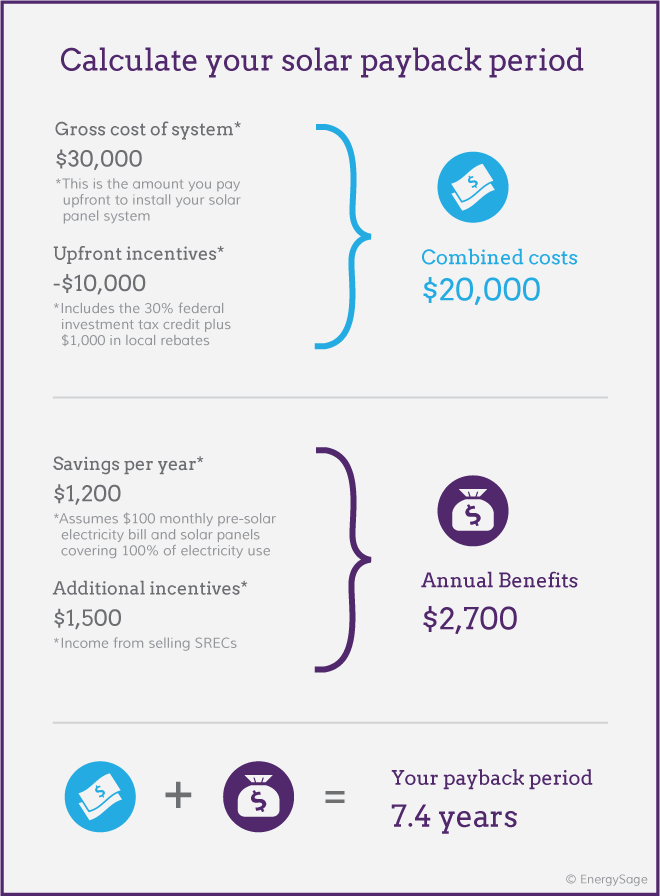

The federal government provides a solar tax credit known as the investment tax credit itc that allow homeowners and businesses to deduct a portion of their solar costs from their taxes.

Find an authorised retailer.

Once you are confirmed as eligible solar victoria will provide you a unique eligibility number and qr code that must be scanned by your installer in order to proceed with your installation.

Both homeowners and businesses qualify for a federal tax credit equal to 26 percent of the cost of their solar panel system minus any cash rebates.

Rebates for victorian rental properties.

The solar retailer code of conduct is part of a suite of measures being undertaken by solar victoria.

Eligible households and landlords can apply for solar rebates and interest free loans.