Ny sun brings together and expands existing programs administered by nyserda long island power authority lipa pseg long island and the new york power authority nypa to ensure a coordinated well supported solar energy expansion plan and a transition to a sustainable self sufficient solar industry.

Solar panel rebates long island.

In one of the three zones the long island region the program has already closed at least for residential applicants.

New york state plans to take over management of a popular solar panel rebate program long handled by lipa and more recently pseg long island with a road map to end rebates in 2017 or sooner.

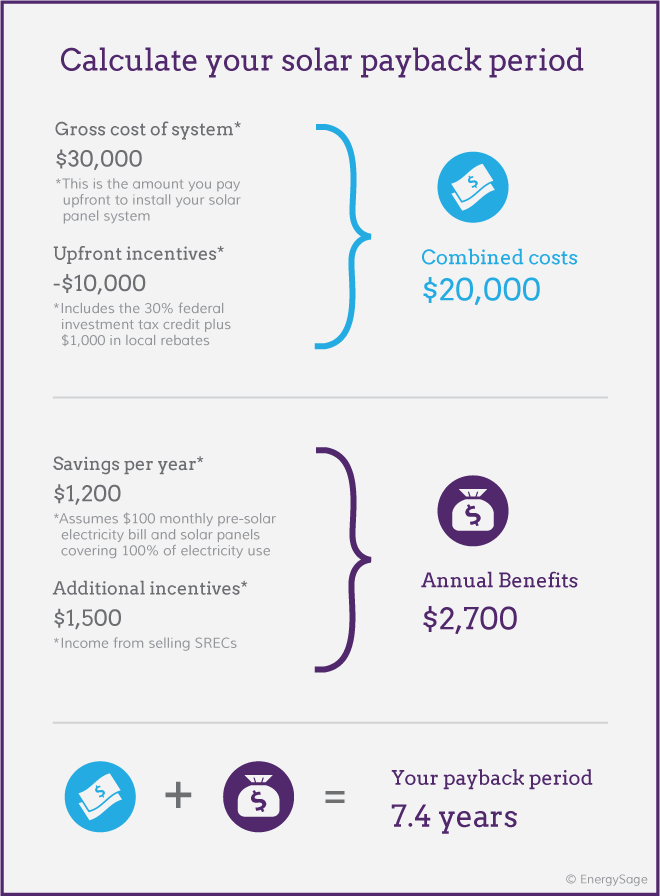

That means that if you install a 4 000 watt system you will receive a grant of 1 200.

Megawatt block incentives in the remaining two zones hover around 30 cents per watt for residential buildings.

The federal government provides a solar tax credit known as the investment tax credit itc that allow homeowners and businesses to deduct a portion of their solar costs from their taxes.

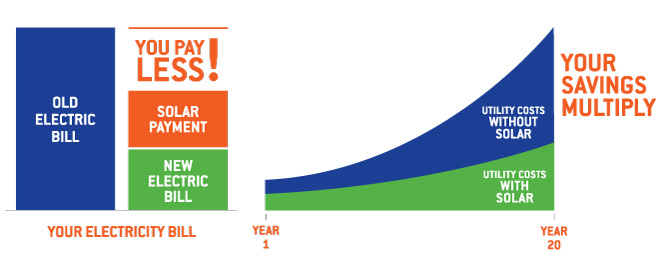

Solar panels produce energy that powers your home charges the batteries or feeds into the energy grid.

Hurricane laura approaches long island.

The pv panels or solar modules the inverter the battery the critical load panel and the electric meter.

Components of solar pv battery storage system.

The credit can be used for up to 20 years.

New york also has a state incentive called the residential solar tax credit.

Pseg long island to reimburse customers for food and medicines spoiled during tropical storm isaias.

This is also a tax credit but will cover up to 25 of the total cost with a maximum credit value of 5000.

Solar pv paired systems are made up of 5 components.

Both homeowners and businesses qualify for a federal tax credit equal to 26 percent of the cost of their solar panel system minus any cash rebates.

Long island s home solar panel system incentive of up to 5 000 for those who choose to purchase finance or lease.