This earns you a 2 500 rebate while the course helps you get the knowledge you need to make an informed decision reduce your energy bills and improve the environment.

Solar panel rebates 2017 texas.

These electric solar systems are becoming more affordable every day because of cps energy rebates and federal tax credits.

Solar photovoltaic pv systems convert sunlight to electricity.

Here are some examples.

60 cents per watt rebate for local installers roughly 15 20 8 cent rebate for using locally made mission solar panels less than 5 only solar installers registered with cps are eligible.

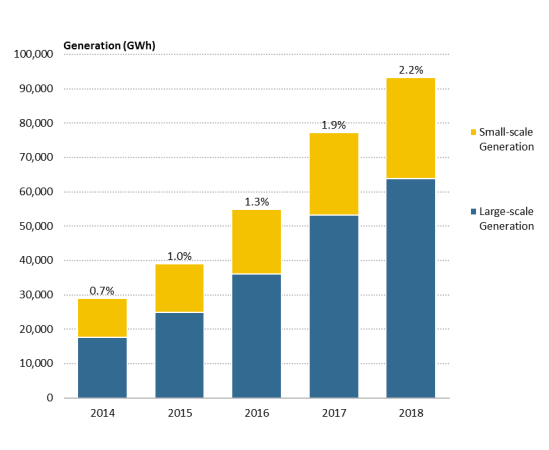

And the power produced by these installations is increasing rapidly.

All of texas can take advantage of the 26 federal tax credit which will allow you to recoup 26 of your equipment and installation costs for an unlimited amount.

An average sized residential solar system about 400 square feet of solar panels costs 18 000 according to the solar energy industries association an industry group.

A recent report by environment texas and frontier group indicates san antonio leads the state in solar pv capacity and ranks eighth among u s.

The city of austin offers a residential solar rebate program which requires homeowners to complete a solar education course followed by installation of a qualifying solar photovoltaic pv system in your home.

Solar generating your own clean power.

Talk to a local installer about the incentives available in your area.

So they can be a great way to boost a home s energy efficiency and environmental friendliness.

The solar rebate varies between 0 40 and 0 80 per watt depending on the system size up to 30 000 and not to exceed 50 of the total installation cost if the solar project includes battery storage the rebate increases to between 0 60 and 1 20 per watt the funds are limited and the rebate is renewed each october.

If you live in austin you can get a rebate of 2 500.

The tax break reduces.

Here is the basic information on how it works.

The federal government provides a solar tax credit known as the investment tax credit itc that allow homeowners and businesses to deduct a portion of their solar costs from their taxes.

Not to worry though cps has come out with a new and improved rebate program for 2017.

Texas solar rebate programs.

Between december 2016 and december 2017 net solar power generated by texas utilities and small scale solar pv facilities pdf rose by more than 107 percent from 96 000.

While texas doesn t have a statewide solar tax credit or solar rebate program many utilities large and small and local governments offer incentives to homeowners who want to go solar.

There may still be other local rebates from your city county or utility.

Both homeowners and businesses qualify for a federal tax credit equal to 26 percent of the cost of their solar panel system minus any cash rebates.