An average sized residential solar system about 400 square feet of solar panels costs 18 000 according to the solar energy industries association an industry group.

Solar panel incentives 2017.

To encourage the continued expansion of solar governments utilities and other organizations offer solar tax breaks and financial incentives to make solar more accessible for today s homeowners.

The itc applies to both residential and commercial systems and there is no cap on its value.

Filing requirements for solar credits.

Srecs is an acronym that stands for solar renewable energy certificates they re like proof that your panels generate renewable energy and they re very valuable because utilities in some states will pay big money for that proof in order to avoid fines for not producing enough electricity from solar.

You calculate the credit on the form and then enter the result on your 1040.

Participants are eligible for up to eight years of annual incentive payments on kilowatt hours generated july 1 2017 through no later than june 30 2029 or until payments add up to 50 of the total system cost.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

25 of total system cost up to 35 000.

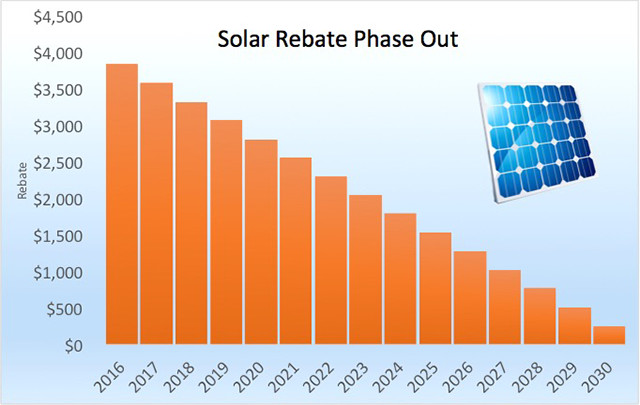

These rebates can pay solar shoppers anywhere from 500 total to 0 95 per watt of installed capacity.

Residential property updated questions and answers.

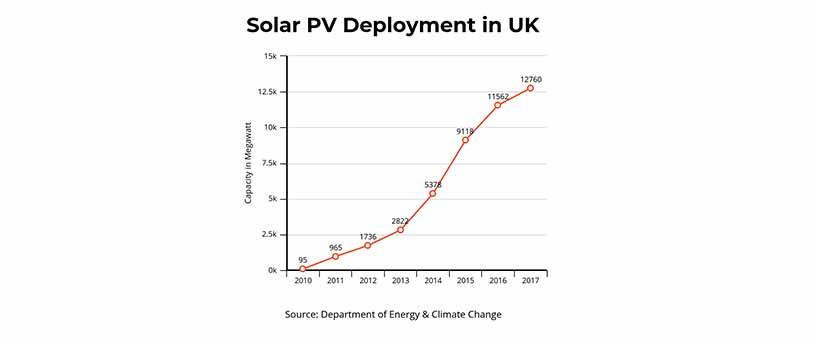

Solar also brings economic benefits for la as a catalyst for creating jobs and stimulating the green economy.

The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.

Here are just two.

Local solar projects also support the reliability of ladwp s power grid.

Some solar roofing tiles and solar roofing shingles serve as solar electric collectors while also performing the function of traditional roofing serving both the functions of solar electric generation and structural support and such items may qualify for.

They are considered distributed generation and function as mini power plants that generate energy right where it is used.

Homeowners have access to rebate programs in many areas of the golden state.

Energy incentives for individuals.

Check out our top list of incentives to go solar in california.

What are the main california solar tax credits and rebates.

First a little terminology.

To claim the credit you must file irs form 5695 as part of your tax return.

The tax break reduces the.